How Tariffs AffectP&C Insurance Prospects

Tariffs and threats of tariffs have been roiling financial markets since January. Property and casualty insurers are no less concerned, as the cost of repairing and replacing damaged property is a driver of claim costs and, ultimately, policyholder premiums. Triple-I Chief Economist and Data Scientist Dr. Michel Léonard recently sat down to explain the implications of tariffs and trade barriers for insurers and what economic considerations concern industry decisionmakers. While property and casualty insurers write many kinds of coverage, the lines Léonard primarily discussed were homeowners and personal and commercial auto – “lines that have a physical emphasis on repair, rebuild, and replace.” Lumber from Canada; cars, trucks, and parts…

Florida ReformsBear Fruit as Premium Rates Stabilize

Florida’s legislative reforms to address claim fraud and legal system abuse are stabilizing the state’s property/casualty insurance market, according to the latest Triple-I Issues Brief. Claims-related litigation has significantly declined over the past two years, and premium averages are nearly flat, with several insurers requesting rate decreases from the state’s insurance regulator. In addition, the brief says, the number of insurers writing business in the state has rebounded after a multi-year exodus. This competition from the private market has allowed policyholders to leave Citizens Property Insurance Corp. – the state-run insurer of last resort – to obtain coverage at previously unavailable rates from a much healthier private market. According to…

Track your car insurance details online in minutes

In India, you can easily check your car insurance details online through platforms such as the Parivahan Portal, IIB Portal, mParivahan app, and state RTO websites. These government-run resources allow you to quickly access your vehicle’s insurance status, policy issuer, and validity by entering the registration number.

IRC report reveals that one in three drivers were either uninsured or underinsured in 2023.

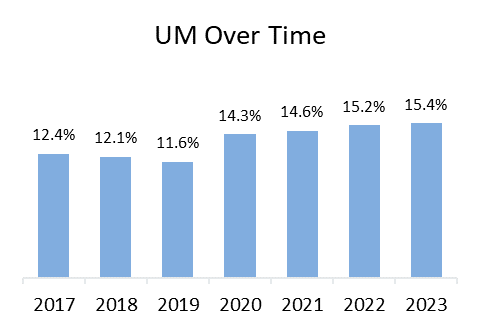

In 2023, despite nearly universal legal requirements to have auto insurance, more than one in seven drivers (15.4 percent) nationally were uninsured, and more than one in six drivers (18.0 percent) were underinsured, according to the new report, Uninsured and Underinsured Motorists: 2017–2023, by the Insurance Research Council (IRC), affiliated with The Institutes. Across the fifty states and the District of Columbia, one in three drivers (33.4 percent) were either uninsured or underinsured in 2023, a 10 percentage point increase in the combined rate since 2017. Using data submitted by 17 insurers — representing approximately 55 percent of the private passenger auto insurance market countrywide — this latest report…

New Triple-I Issue Brief Puts the Spotlight on Georgia’s Insurance Affordability Crisis

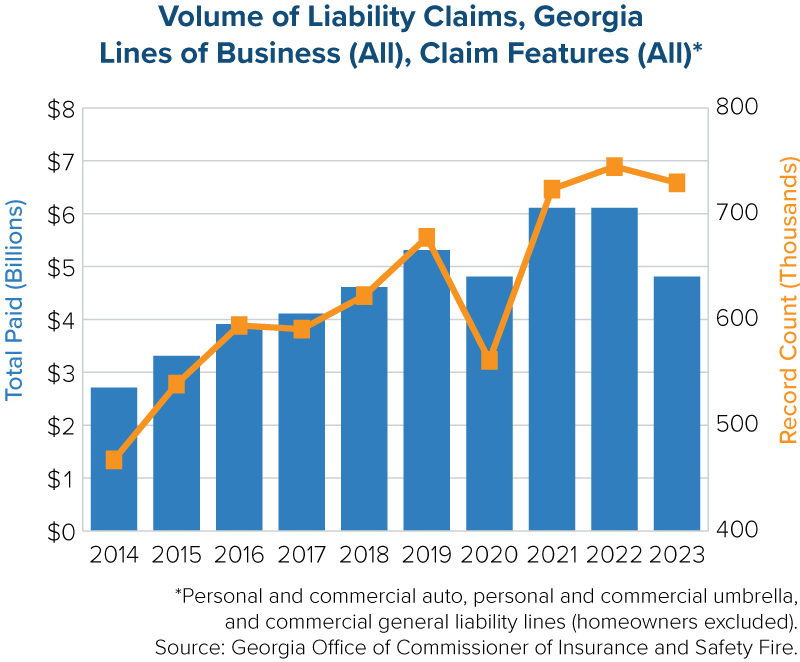

Insurance affordability in Georgia is dwindling as claim frequency and insurer costs soar, according to the latest issue brief from Insurance Information Institute (Triple-I), Trends and Insights: Georgia Insurance Affordability. Given the state’s below-average income vs. above-average insurance expenditures, Georgia ranks 42nd on the list of affordable states for homeowners insurance and 47th (plummeting from the 2006 high of 27th) for personal auto affordability, according to reports by the Insurance Research Council. This brief provides an overview of how several factors, including skyrocketing costs from litigation, pose risks to coverage affordability, availability, and other potential economic outcomes for Georgia residents. Tort reform is discussed as a legislative solution to the…

Executive Exchange: Importing European Safety to U.S. Roads

Road safety efforts in Europe offer numerous examples and success stories from which U.S. jurisdictions are learning. In the latest Triple-I Executive Exchange, MAPFRE USA President and CEO Jaime Tamayo sat down with Triple-I CEO Sean Kevelighan to discuss these learnings from an insurance perspective. “In Europe, road-related fatalities are significantly lower than in the U.S., and we wanted to get a better understanding as to why,” Tamayo said. “We brought together leading experts and policymakers from Europe and the U.S. in transportation, urban planning, public health, and technology to discuss ways in which we can improve policies, innovation, enforcement, and education around safe driving.” Through its charitable foundation, Fundación…

Executive Exchange: RiskScan Survey Taps Cross-Market Viewpoints

For insurers, “customer” is one word that encompasses individual policyholders, business owners, risk managers, agents and brokers, and others, all with different (often divergent) priorities. For reinsurers – whose primary customers are insurers themselves – “understanding the customer” is particularly challenging. This was part of the motivation behind RiskScan 2024 – a collaborative survey carried out by Munich Re US and Triple-I. The survey provides a cross-market overview of top risk concerns among individuals across five key market segments: P&C insurance carriers, P&C agents and brokers, middle-market business decision makers, small business owners, and consumers. It explores not only P&C risks, but also how economic, political, and legal pressures shape…

Louisiana Reforms: Progress, But MoreIs Needed to StemLegal System Abuse

Reforms put in place in 2024 are a positive move toward repairing Louisiana’s insurance market, which has long suffered from excessive claims litigation and attorney involvement that drive up costs and, ultimately, premium rates. But more work is needed, Triple-I says in its latest Issues Brief. Research by the Insurance Research Council (IRC) – like Triple-I, an affiliate of The Institutes – shows Louisiana to be among the least affordable states for both personal auto and homeowners insurance. In 2022, the average annual personal auto premium expenditure per vehicle in Louisiana was $1,588, which is nearly 40 percent above the national average and nearly double that of the lowest-cost Southern…

When will your insurer not cover claims under your third-party motor insurance?

Driving in India without third-party (TP) insurance is illegal and can result in financial burdens if caught without a valid policy. However, even when you have a TP cover, there may be instances where your TP insurer may refuse to cover damages and injuries caused to third parties by the insured vehicle. Read on to learn more about such conditions, the recourses available and the number of times you can avail yourself of third-party motor insurance.

JIF 2024: What Resilience Success Looks Like

By Lewis Nibbelin, Contributing Writer, Triple-I The efficacy of collaboration and investment by “co-beneficiaries” in resilience initiatives was a dominant theme throughout Triple-I’s 2024 Joint Industry Forum – particularly in the final panel, which celebrated leaders behind recent real-world impacts of such investments. Moderated by Dan Kaniewski, Marsh McLennan (MMC) managing director for public sector, the panelists discussed how their multi-industry backgrounds inform their innovative mindsets, as well as their knowledge on the profound ripple effects of targeted resilience planning. The panel included: Jonathan Gonzalez, co-founder and CEO of Raincoat; Bob Marshall, co-founder and CEO of Whisker Labs; Dawn Miller, chief commercial officer of Lloyd’s and CEO of Lloyd’s Americas; and…