Auto Insurance

Florida Senate RejectsLegal-Reform Challenge

By Lewis Nibbelin, Contributing Writer, Triple-I The Florida House’s attempt to curtail recent legal system reforms met firm resistance from the state Senate this week, preserving the 2022 and 2023 legislation that stabilized the state’s property insurance market. Aiming to reinstate one-way attorney fees in insurance litigation, the House added an amendment – originally part of a separate bill – to an unrelated Senate bill focused on creating legal protections for owners of former mining sites. Filed by state Rep. Berny Jacques, the amendment would have restored Florida’s previous requirement for insurers to shoulder the insured’s legal costs, even if the insured’s jury award was only slightly higher than the…

Tariff Uncertainty May Strain Insurance Markets, Challenge Affordability

Chief Economist and Data Scientist, Dr. Michel Léonard Recent tariffs issued by U.S. President Donald Trump are on track to increase the price of parts and materials used in repairing and restoring property after an insurable event. Analysts and economists, predict these price hikes will lead to higher claim payouts for P&C insurers and, ultimately, higher premiums for policyholders. After making several announcements since early March 2025, on April 2, President Trump signed an executive order imposing a minimum 10 percent tariff on all U.S. imports, with higher levies on imports from 57 specific trading partners. A general tariff rate became effective on April 5, while tariffs on imports from…

Despite Progress, California Insurance Market Faces Headwinds

Even as California moves to address regulatory obstacles to fair, actuarially sound insurance underwriting and pricing, the state’s risk profile continues to evolve in ways that impede progress, according to the most recent Triple-I Issues Brief. Like many states, California has suffered greatly from climate-related natural catastrophe losses. Like some disaster-prone states, it also has experienced a decline in insurers’ appetite for covering its property/casualty risks. But much of California’s problem is driven by regulators’ application of Proposition 103 – a decades-old measure that constrains insurers’ ability to profitably write business in the state. As applied, Proposition 103 has: Kept insurers from pricing catastrophe risk prospectively using models, requiring them…

Even With Recent Rises, Auto Insurance Is More Affordable Than During Most of Century to Date

You read that right. As a percentage of median household income, personal auto insurance premiums nationally were more affordable in 2022 (the most recent data available) than they have been since the beginning of this century. And even the premium increases of the past two years are only expected to bring affordability back into the 2000 range, according to the Insurance Research Council (IRC). A new IRC report – Auto Insurance Affordability: Countrywide Trends and State Comparisons – looks at the average auto insurance expenditure as a percent of median income. The measure ranges from a low of 0.93 percent in North Dakota (the most affordable state for auto insurance)…

How Tariffs AffectP&C Insurance Prospects

Tariffs and threats of tariffs have been roiling financial markets since January. Property and casualty insurers are no less concerned, as the cost of repairing and replacing damaged property is a driver of claim costs and, ultimately, policyholder premiums. Triple-I Chief Economist and Data Scientist Dr. Michel Léonard recently sat down to explain the implications of tariffs and trade barriers for insurers and what economic considerations concern industry decisionmakers. While property and casualty insurers write many kinds of coverage, the lines Léonard primarily discussed were homeowners and personal and commercial auto – “lines that have a physical emphasis on repair, rebuild, and replace.” Lumber from Canada; cars, trucks, and parts…

Florida ReformsBear Fruit as Premium Rates Stabilize

Florida’s legislative reforms to address claim fraud and legal system abuse are stabilizing the state’s property/casualty insurance market, according to the latest Triple-I Issues Brief. Claims-related litigation has significantly declined over the past two years, and premium averages are nearly flat, with several insurers requesting rate decreases from the state’s insurance regulator. In addition, the brief says, the number of insurers writing business in the state has rebounded after a multi-year exodus. This competition from the private market has allowed policyholders to leave Citizens Property Insurance Corp. – the state-run insurer of last resort – to obtain coverage at previously unavailable rates from a much healthier private market. According to…

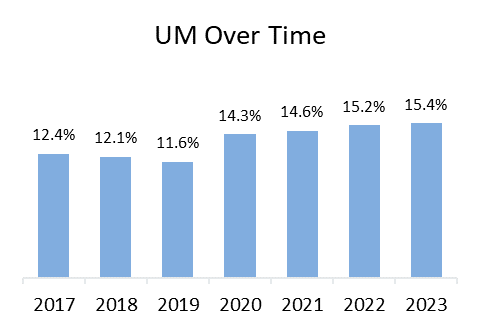

IRC report reveals that one in three drivers were either uninsured or underinsured in 2023.

In 2023, despite nearly universal legal requirements to have auto insurance, more than one in seven drivers (15.4 percent) nationally were uninsured, and more than one in six drivers (18.0 percent) were underinsured, according to the new report, Uninsured and Underinsured Motorists: 2017–2023, by the Insurance Research Council (IRC), affiliated with The Institutes. Across the fifty states and the District of Columbia, one in three drivers (33.4 percent) were either uninsured or underinsured in 2023, a 10 percentage point increase in the combined rate since 2017. Using data submitted by 17 insurers — representing approximately 55 percent of the private passenger auto insurance market countrywide — this latest report…

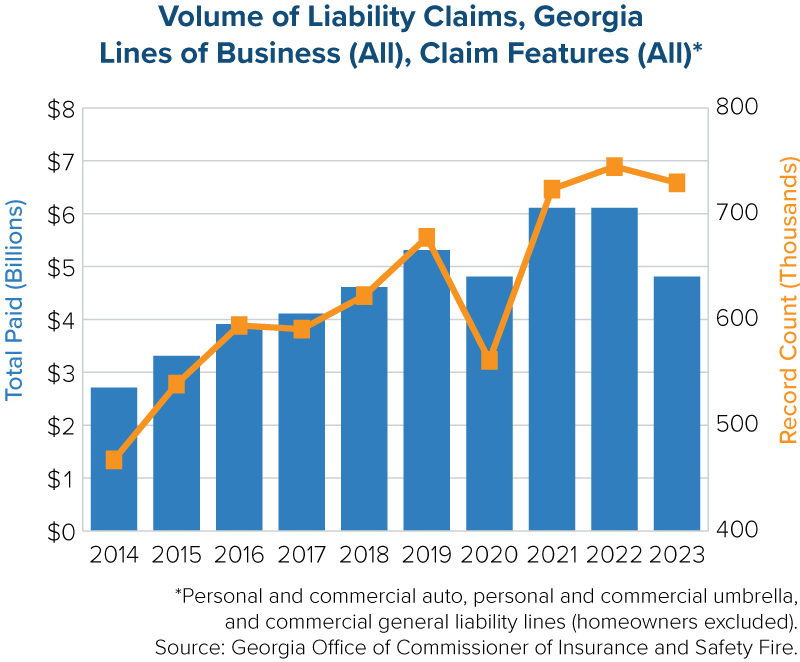

New Triple-I Issue Brief Puts the Spotlight on Georgia’s Insurance Affordability Crisis

Insurance affordability in Georgia is dwindling as claim frequency and insurer costs soar, according to the latest issue brief from Insurance Information Institute (Triple-I), Trends and Insights: Georgia Insurance Affordability. Given the state’s below-average income vs. above-average insurance expenditures, Georgia ranks 42nd on the list of affordable states for homeowners insurance and 47th (plummeting from the 2006 high of 27th) for personal auto affordability, according to reports by the Insurance Research Council. This brief provides an overview of how several factors, including skyrocketing costs from litigation, pose risks to coverage affordability, availability, and other potential economic outcomes for Georgia residents. Tort reform is discussed as a legislative solution to the…

Executive Exchange: Importing European Safety to U.S. Roads

Road safety efforts in Europe offer numerous examples and success stories from which U.S. jurisdictions are learning. In the latest Triple-I Executive Exchange, MAPFRE USA President and CEO Jaime Tamayo sat down with Triple-I CEO Sean Kevelighan to discuss these learnings from an insurance perspective. “In Europe, road-related fatalities are significantly lower than in the U.S., and we wanted to get a better understanding as to why,” Tamayo said. “We brought together leading experts and policymakers from Europe and the U.S. in transportation, urban planning, public health, and technology to discuss ways in which we can improve policies, innovation, enforcement, and education around safe driving.” Through its charitable foundation, Fundación…

Louisiana Reforms: Progress, But MoreIs Needed to StemLegal System Abuse

Reforms put in place in 2024 are a positive move toward repairing Louisiana’s insurance market, which has long suffered from excessive claims litigation and attorney involvement that drive up costs and, ultimately, premium rates. But more work is needed, Triple-I says in its latest Issues Brief. Research by the Insurance Research Council (IRC) – like Triple-I, an affiliate of The Institutes – shows Louisiana to be among the least affordable states for both personal auto and homeowners insurance. In 2022, the average annual personal auto premium expenditure per vehicle in Louisiana was $1,588, which is nearly 40 percent above the national average and nearly double that of the lowest-cost Southern…