Florida Senate RejectsLegal-Reform Challenge

By Lewis Nibbelin, Contributing Writer, Triple-I The Florida House’s attempt to curtail recent legal system reforms met firm resistance from the state Senate this week, preserving the 2022 and 2023 legislation that stabilized the state’s property insurance market. Aiming to reinstate one-way attorney fees in insurance litigation, the House added an amendment – originally part of a separate bill – to an unrelated Senate bill focused on creating legal protections for owners of former mining sites. Filed by state Rep. Berny Jacques, the amendment would have restored Florida’s previous requirement for insurers to shoulder the insured’s legal costs, even if the insured’s jury award was only slightly higher than the…

Louisiana Senator Seeks Resumption of Resilience Investment Program

By Lewis Nibbelin, Contributing Writer, Triple-I Louisiana Sen. Bill Cassidy recently took to the Senate floor to call for restoration of FEMA’s Building Resilient Infrastructure and Communities (BRIC) program, whose elimination the agency announced on April 4. Established by Congress through the Disaster Recovery Reform Act of 2018, the BRIC program has allocated more than $5 billion for investment in mitigation projects to reduce economic losses from floods, wildfires, and other disasters for hundreds of communities. Ending BRIC will cancel all applications from 2020-2023 and rescind more than $185 million in grants intended for Louisiana, leaving the 34 submitted and accepted projects funded by those grants in limbo. Whereas the FEMA…

Why your EV insurance premium is costlier and features you must have in EV motor insurance policy

Electric vehicle insurance premiums are notably higher than those for traditional cars due to EVs’ higher purchase prices and costly battery replacements. Specialized parts, the need for trained technicians, and limited repair networks further contribute to increased costs. Comprehensive policies with battery protection, zero depreciation, and roadside assistance are crucial for EV owners to mitigate potential financial burdens.

ClimateTech Connect Confronts Climate Peril From Washington Stage

The Institutes’ Pete Miller and Francis Bouchard of Marsh McLennan discuss how AI is transforming property/casualty insurance as the industry attacks the climate crisis. “Climate” is not a popular word in Washington, D.C., today, so it would take a certain audacity to hold an event whose title prominently includes it in the heart of the U.S. Capitol. And that’s exactly what ClimateTech Connect did last week. For two days, expert panels at the Ronald Reagan Building and International Trade Center discussed climate-related risks – from flood, wind, and wildfire to extreme heat and cold – and the role of technology in mitigating and building resilience against them. Given the human…

BRIC Funding Loss Underscores Need for Collective Action on Climate Resilience

The Trump Administration’s unwinding of the Building Resilient Infrastructure and Communities (BRIC) program and cancellation of all BRIC applications from fiscal years 2020-2023 reinforce the need for collaboration among state and local government and private-sector stakeholders in climate resilience investment. Congress established BRIC through the Disaster Recovery Reform Act of 2018 to ensure a stable funding source to support mitigation projects annually. The program has allocated more than $5 billion for investment in mitigation projects to alleviate human suffering and avoid economic losses from floods, wildfires, and other disasters. FEMA announced on April 4 that it is ending BRIC . Chad Berginnis, executive director of the Association of State Floodplain…

Tariff Uncertainty May Strain Insurance Markets, Challenge Affordability

Chief Economist and Data Scientist, Dr. Michel Léonard Recent tariffs issued by U.S. President Donald Trump are on track to increase the price of parts and materials used in repairing and restoring property after an insurable event. Analysts and economists, predict these price hikes will lead to higher claim payouts for P&C insurers and, ultimately, higher premiums for policyholders. After making several announcements since early March 2025, on April 2, President Trump signed an executive order imposing a minimum 10 percent tariff on all U.S. imports, with higher levies on imports from 57 specific trading partners. A general tariff rate became effective on April 5, while tariffs on imports from…

Higher motor insurance premium this year if more than 2 traffic challans levied last year? Here’s what experts say

Proposed rules linking traffic violations to higher insurance premiums are under consideration at present. Stricter rules for traffic violations are also being proposed. Experts anticipate that premium pricing might involve a tiered model based on pending challans, potentially using telematics for risk assessment. However, there are valid concerns regarding inflated premiums in cases where challans have been erroneously and wrongfully generated.

Despite Progress, California Insurance Market Faces Headwinds

Even as California moves to address regulatory obstacles to fair, actuarially sound insurance underwriting and pricing, the state’s risk profile continues to evolve in ways that impede progress, according to the most recent Triple-I Issues Brief. Like many states, California has suffered greatly from climate-related natural catastrophe losses. Like some disaster-prone states, it also has experienced a decline in insurers’ appetite for covering its property/casualty risks. But much of California’s problem is driven by regulators’ application of Proposition 103 – a decades-old measure that constrains insurers’ ability to profitably write business in the state. As applied, Proposition 103 has: Kept insurers from pricing catastrophe risk prospectively using models, requiring them…

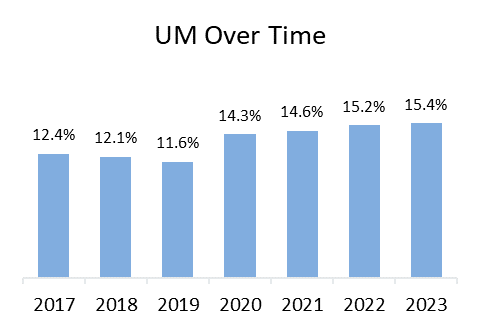

Even With Recent Rises, Auto Insurance Is More Affordable Than During Most of Century to Date

You read that right. As a percentage of median household income, personal auto insurance premiums nationally were more affordable in 2022 (the most recent data available) than they have been since the beginning of this century. And even the premium increases of the past two years are only expected to bring affordability back into the 2000 range, according to the Insurance Research Council (IRC). A new IRC report – Auto Insurance Affordability: Countrywide Trends and State Comparisons – looks at the average auto insurance expenditure as a percent of median income. The measure ranges from a low of 0.93 percent in North Dakota (the most affordable state for auto insurance)…

What influences your motor insurance premium—and tips to save it

Motor insurance premiums involve various factors like payment modes, claim history, and policy purchase method. Choosing strategic options such as spreading payments, leveraging No-Claim Bonuses, opting for Pay As You Drive, avoiding dealer-driven policies, and making smart deductible choices can significantly reduce premiums without compromising coverage.